In March 2016, data from NBS showed that

China's total output of Li-ion battery in 2015 increased by 3.13% YoY, indicating

a slowdown in the output growth rate. However, many industry insiders believed

that it was not the growth rate of output but the growth rate of battery

capacity that could reflect the real situation of Li-ion battery industry.

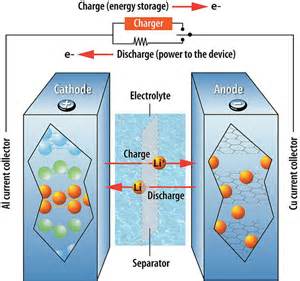

Source: Bing

On 3 March 2016, data from the National

Bureau of Statistics of the People’s Republic of China (NBS) showed that only

5.6 billion Li-ion batteries were produced in China last year, up by 3.13% YoY

over 5.43 billion in 2014. Obviously, the increase of Li-ion battery output has

slowed down, comparing with the 10% annual growth rate in previous years.

However, many industry insiders believed that it was not the growth rate of

output but the growth rate of battery capacity that could reflect the real

situation of Li-ion battery industry. This is true, because most domestic power

Li-ion batteries (for alternative energy vehicles) are large-capacity soft

Li-ion battery cells packs. Actually, China’s Li-ion battery market structure

is changing smoothly.

In 2010-2012, the domestic output of Li-ion

batteries increased sharply from 2.51 billion to 4.18 billion, thanks to the

rapid increase of consumer electronics, such as mobile phones and laptops. The

YoY growth rate in 2012 even reached 36.16%. However, the growth has slowed

down since 2013.

In 2014, the output of Li-ion battery exceeded 5 billion pieces for the first

time, but the growth rate dropped significantly in 2015, and even down to

negative growth rate, leading to an annual growth rate of only 3.13%, a record

low since the industrialization of the industry.

Output and YoY growth rate of Li-ion

battery in China, 2010–2015

Source: National Bureau of Statistics of

the People’s Republic of China

Significant changes in application

- Consumer electronics:

The overall annual output of consumer

electronics increased steadily, but some products witnessed a YoY decline. This

led to record weak demand for Li-ion battery. The domestic output of some

electronics in 2015 was as follows:

Mobile phones: 1.82 billion, up by 3.9%

YoY;

Notebook computers (including tablet PC):

175 million, down by 16.8% YoY;

Digital cameras: 19.23 million, down by

20.4% YoY.

- Alternative energy vehicle:

Chinese Li-ion battery industry has been

driven by the alternative energy vehicle industry, which began to develop

rapidly since 2014. The domestic output of alternative energy vehicles was

increasing rapidly, thanks to the promotion by the national and local

governments. In 2015, the domestic output of alternative energy vehicles was

379,000, an increase of 400% YoY.

The changes of consumption pattern helped increase the market share of power

Li-ion battery in domestic Li-ion battery market. In 2014-2015, the market

share of power Li-ion battery has soared from 13% to 52%, exceeding that of

consumer Li-ion battery, whose market share has dropped from 83% to 46%.

- Energy storage:

The domestic market share of energy storage Li-ion battery has dropped from 4%

in 2014 to 2% in 2015, because of the rapid growth of power Li-ion battery,

although more energy storage Li-ion batteries will be applied in mobile

communication and the construction of energy storage station has speeded up.

Changes of market structure led to

polarization in regional industrial distribution.

The top 3 production areas of traditional Li-ion battery in China are the Pearl

River Delta Region (including Guangdong and Fujian provinces), the Yangtze

River Delta Region (including Shanghai, Jiangsu and Zhejiang) as well as the

Beijing-Tianjin-Hebei Region (including Beijing, Tianjin, Hebei).

The former further strengthen its leading position, while the positions of the

latter two are declining, due to the transformation and upgrades of consumer

electronic products, the rapid development of alternative energy vehicle

market, the industrial transfer etc.

The output of Li-ion battery in this 3 production areas in 2015 were as

follows:

Pearl River Delta Region: increased by 20%

YoY to 3.04 billion pieces, accounting for 54.3% of the national total. Amongst

them, 2.36 billion pieces were from Guangdong Province, accounting for 42.1% of

the national total

Yangtze River Delta Region: dropped by 5.2%

YoY to 1.09 billion pieces, accounting for 19.5% of the national total. This

was mainly due to environmental constraints

Beijing-Tianjin-Hebei Region: dropped by

20% YoY to 440 million pieces, accounting for 7.9% of the national total. This

was mainly due to the acceleration of industrial transfer in the region

But it is worth noting that, driven by the booming alternative energy vehicle

industry, the domestic Li-ion battery industry has been developing rapidly in

some provinces and cities. For example, in 2012-2015, the output of Li-ion

battery in Anhui and Shandong provinces has increased from 35 million pieces to

126 million pieces, with an average annual growth rate of 53%.

Besides, the Central and Western Region (including Jiangxi, Hubei, Hunan,

Guizhou, Yunnan provinces and Chongqing Municipality) has made full use of cost

advantage to take Li-ion battery industry transferring from other areas. In

2015, the output of Li-ion battery in this region was 750 million pieces,

accounting for 13.4% of the national total.

In 2016, China's Li-ion battery market

structure is expected to change further.

- Demand:

The market share of consumer Li-ion battery

will continue to decline while that of Li-ion battery will continue to

increase. This is because the consumer electronics market is nearly saturated

The alternative energy vehicle market will

maintain the momentum of rapid growth, pushing by the target of consuming 5

million alternative energy vehicles by 2020

The demand for energy storage Li-ion

battery will continue to increase, since PV installed capacity is increasing

rapidly and the application of Li-ion battery in communication field is also

accelerating

- Regional distribution:

Anhui Province, Shandong Province and the

Central and Western Region will continue the momentum of rapid growth

The Pearl River Delta Region won’t witness significant

growth rate, as the current output is already very huge

The Yangtze River Delta Region and the

Beijing-Tianjin-Hebei Region will inevitably continue the downward trend

* This article comes from China Li-ion Battery News 1603, CCM

About CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content

solutions, from price and trade data to industry newsletters and customized

market research reports. Our clients include Monsanto, DuPont, Shell, Bayer,

and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in touch with us directly by emailing

econtact@cnchemicals.com or calling +86-20-37616606.

Tag: Li-ion battery , alternative energy vehicles